How Can We Help?

What is a Scenario

A scenario is a tool to help you grade the value of a change to your finances. A scenario allows you to make a hypothetical change that can then be seen on your financial reports. You can make a change like buying a home. If you bought a home it would show in your Pocket Plan on the Net Worth report as an Asset. Your home would also likely carry a mortgage that would then be viewed on your monthly cash flow statement. A scenario helps you make better financial decisions.

Scenarios are calculators that help you test the value of a change measured in a financial report.

You can Build the following Scenario types with Pocket Plan:

- Debt

- Investment

- Portfolio

- Retirement

Each Scenario type allows you to test something different. You can create as many scenarios as you want and change multiple inputs to get the exact desired outcome.

Scenarios are for modeling purposes only. They do not represent an absolute outcome. Scenarios are for educational purposes only. They should not be considered financial advice.

How to use Scenarios

You can use scenarios to help you make better financial decisions. The range of possibilities is based on your personal situation and goals. Start by checking your Retirement Score. What changes would it take to get your Retirement Score to 100? Could you start making those changes today based on your cash flow? What if you were to pay off your debt? What if you started a new investment account?

Start by confirming all of your accounts are connected to Pocket Plan. Use the Secure Link to connect your accounts to a live data feed.

Then create a new scenario

Scenario Types

Debt

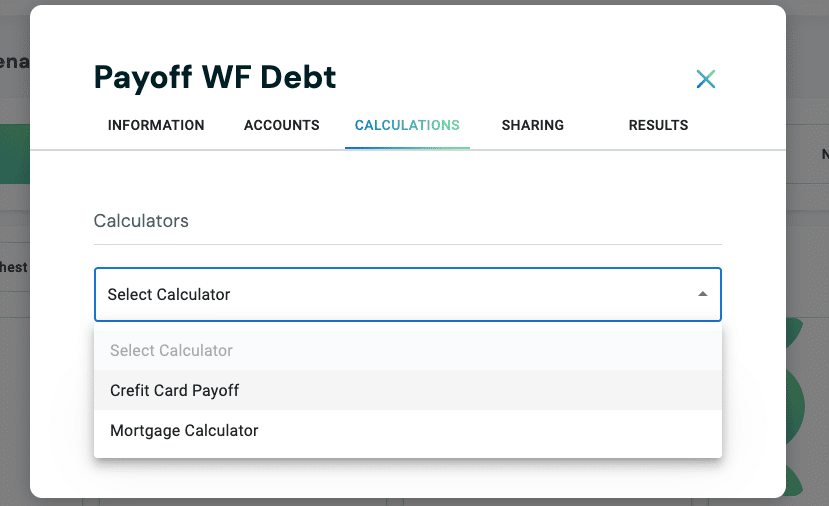

Debt scenarios help you view the cost of financing debt. You can adjust inputs including the loan principal, monthly payment, interest rate & term.

Debt Scenarios

– Mortgage Calculator

– Credit Card Calculator

When you click Run Scenario you’ll be shown the results in the Results Tab. This will allow you to see the difference in payments, interest paid & payback period.

Invest

Portfolio

Improve your investment decisions with Portfolio. Check your cost basis, gains and performance using Portfolio. This scenario is ideal if you’d like to

Retirement

Retirement Scenario Inputs

- Retirement Age

- Current Savings Amount

- Retirement Spending Value

Add Images

You can add up to five images to any scenario. These are helpful to remember the account that’s involved or simply the goal of the scenario. Adding an image to your scenario makes it easy to identify for future changes.

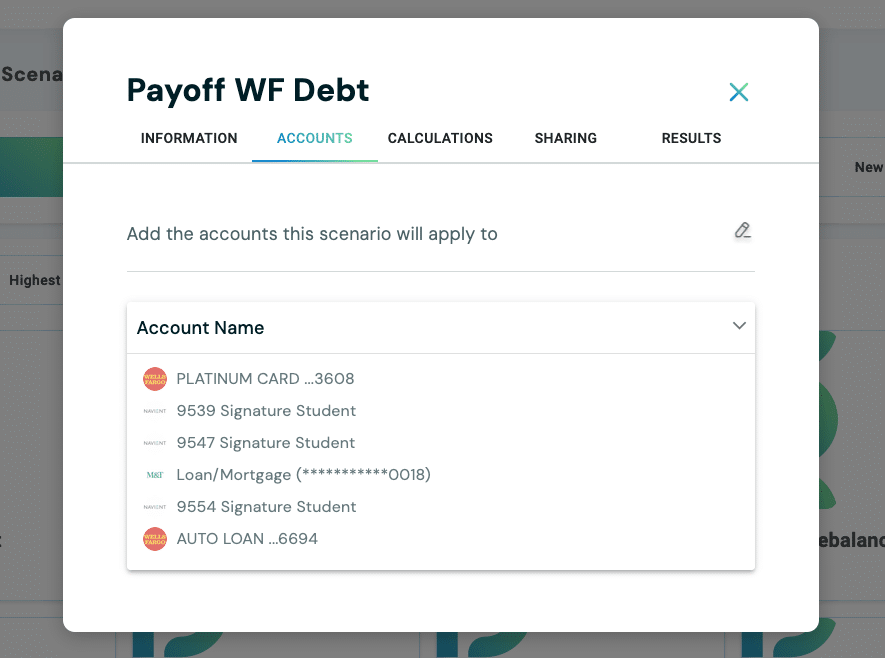

Accounts

For Debt Scenarios you can apply the scenario to a Linked Account. The Mortgage or Credit Card Calculator will take the details from your account including:

– Monthly Payment

– Interest Rate

You can make adjustments to the different calculation depending on your intended goal. For instance, if you want to minimize interest you may consider adjusting the monthly payment. By paying the maximum value you can monthly you’ll reduce how much principal is available for interest expense.

At a certain point you may find that the monthly payment is beyond your cash flow. So, identifying the right payment that helps

Calculations

Scenario Sharing

You can share your scenario with a partner or advisor. To do so, simply go to the Sharing Settings of your scenario. You’ll need to turn on Share Scenario to make the scenario shareable.

When you share your scenario it becomes available to be viewed by someone of your choice. This person can view the scenario and make adjustments. They can also save it to their library to keep track of the progress on the goal.

To disconnect a shared scenario simply go to the Scenario > Sharing tab and turn the Share Scenario button off.

If a scenario is public it can not be shared with an advisor.

Use Scenarios to Test:

- Best Retirement Date

What’s the difference in monthly income and expenses if you retire at age 62 vs 65 or 67? Change your Retirement Date to test your outcome. - Odds of Running out of money in Retirement

- How Much to Spend in Retirement