Why Investors Should Care About Bonds

Are you concerned about investment returns and think that the safe place to have your money is in government bonds, specifically us bonds? Well, if so, pay attention to this article, because you may be surprised about the risk involved with investing in us bonds.

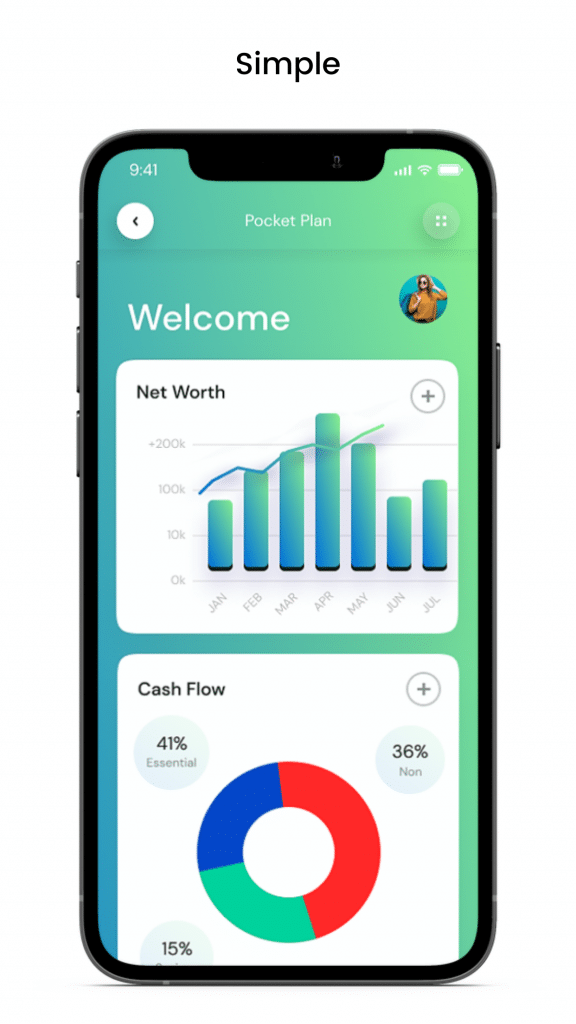

I’m Nathan Garcia, and I’m the founder of pocket plan. And in this video, I’d like to help you to look at the investment risk of us treasuries in a different light. I believe that these are more risky to hold than most people realize. And one of the biggest reasons is because of the current inflationary environment that we’re in, maybe, you know, but inflation is actually at seven and half percent. So if you’re making less than seven and half percent on your money, then you are losing money. And if we look at the returns for bonds, whether it be for one year bonds, five year bonds, 10 year bonds or 30 year bonds, the highest return that you’re getting on those bonds is only about 2%.

Inflation Reduces Your Real Returns

And you have to hold onto that bond for 30 years. It’s a 30 year bond. That’s gonna give you about a 2% return, meaning that you’re guaranteed to lose money just by holding that bond. The, the decision is how much money are you willing to lose? If you’re only investing in a one year bond, you’re saying, Hey, I’m willing to lose 7% on my money. If you’re willing to hold a 30 year bond, you’re saying I’m willing to lose five and a half percent on my money because the real return, the actual value of the money that you receive is less than the inflation rate. And the challenge with that is that it increases the risk for investment holders. Anybody who’s holding these treasuries is knowledgeable about the fact that there’s risk involved in it, mainly liquidity. Can I actually get the money when I need it, or will this ETF not be around?

Liquidity Matters in ETFS

Will I be gated? Meaning that I have to pay fees in order to get my money? The liquidity risk is a risk that is completely overlooked by many asset managers. And as a result, people are surprised when they have to pay additional redemption fees, gating fees, or the fund just says, Hey, we can’t honor your, uh, distribution. We actually can’t return the money to you for a certain amount of time. So bonds are not risk free. You want to be aware of the different risk involved with bonds. As you see here. Now, finally, the us government is running a huge deficit. Maybe you’ve realized, but we’re running about a 3 trillion deficit and you might say, well, yeah, but we’re coming out of the pandemic. Yeah, but we were having issues before that. And there’s no end in sight with this deficit, which means that the investment risk or the likelihood of you being repaid is decreased by our deficit. If we are spending more money than we’re earning, then we are putting our country at risk of default. And you can see here that

Track Your Risk Tolerance and Exposure

The deficit has increased significantly over time.

Even last year, the congressional budget office had estimated that our deficit would be $2 trillion. It came in at about 2.8 or close to $3 trillion.

So our government is spending recklessly and maybe you’ve seen the Build Back Better push from the current administration.

It, that has a huge price tag that is only going to exacerbate this budget. So I want you to be mindful of these investment risks. When you look at bonds, bonds are off to a terrible start this year, and it is a reason for you to be vigilant and to be proactive about your finances and about your future. So if you have questions about your situation and you’d like to help, uh, do you like to get some help then connect with me on pocket plan. I’ll be able to help you out with analyzing your risk and also finding an investment manager who can help put you in a good position. Thanks so much. I look forward to seeing you in the next video, take care.