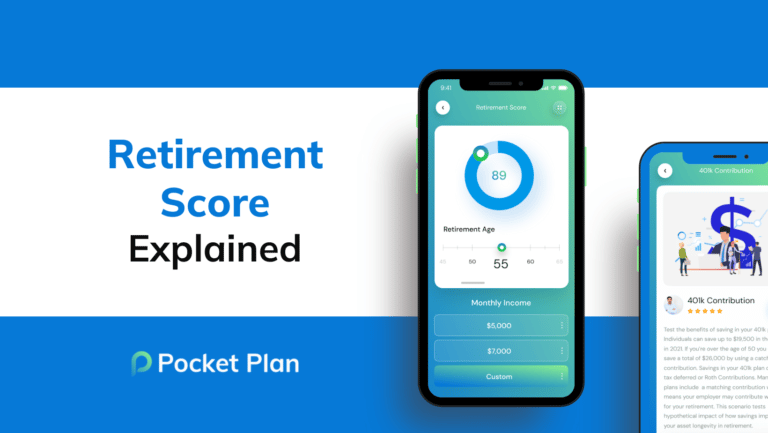

Retirement Score Explained

The retirement score is a measure of the odds that your money will last until age eighty six.

If you have a high retirement score, it means you have good odds of not running out of money before age eighty six.

If you have a low retirement score, it means you are likely to run out of money before the intended time.

The retirement score is made up of personal information including age, retirement age, how much money is needed in retirement, and how much is currently invested.

It also looks at the inflation rate and how success is defined.

Expected portfolio value is calculated assuming returns continue at a set amount

each year

Simulated portfolio uses real market returns from the S&P 500 to estimate future

value

We can add in a random shock to see what the returns would be during a specific

time period. For example, we could look at returns from 1929 to 1959 or 1961 to 1991.

By adding in a random variable, we can mimic real world results and get a more accurate idea of the odds of success.

To get a realistic retirement score, input your goals and run the calculation. It will take longer for more trials, but this will give you your best case, worst case, and median results.

Stick to median results most of the time for a more accurate view of what will happen with money majority of the time.

Retirement score can be improved by changing inputs like income and percentage needed.

You can create a new retirement scenario by clicking the “add scenario” button and customizing the inputs.

If you want to see what would happen if you increased your retirement age, go to the “scenarios” tab, edit your current scenario, and change the retirement age input. Then, go back to the “plan” tab and observe the changes in your retirement score.

The retirement score would change significantly if the inflation rate was dropped from 5.4% to the historic average of 2.4%.

Savings rate significantly increases retirement score.

Understanding how changes to finances will influence future wellbeing is important.