The Power of Network Effects:

Unlocking Growth for Financial Advisors

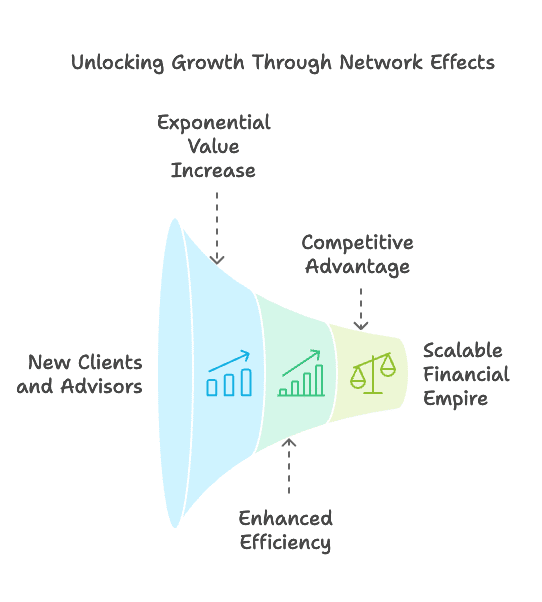

Imagine a world where each new client or advisor you bring on board makes your business exponentially more valuable. It’s not magic—it’s the power of network effects. And in today’s financial services landscape, this business model has the potential to transform how you scale, serve clients, and build a competitive moat around the Gradient empire that you’ve worked so hard to create.

Let’s explore how Pocket Plan can supercharge the network between advisors and clients to unlock growth, gain efficiency, and ensure you stay ahead of the competition.

What Are Network Effects?

A Simple,Game-Changing Idea

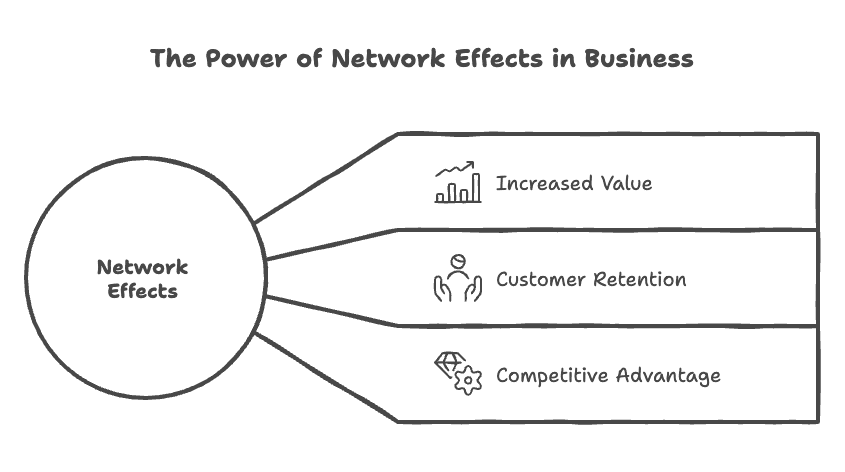

At its core, a network effect happens when a product or service becomes more valuable as more people use it. Think of it as a flywheel that spins faster and faster: every new participant strengthens the entire network.

Consider Uber: they connect riders who need transportation with drivers who can provide it. More drivers mean shorter wait times and better coverage, which attracts more riders. More riders, in turn, bring more drivers. Uber doesn’t own the cars—they own the network.

This same principle underlies some of the most successful businesses in history:

Google AdWords

connects people searching for products with businesses ready to sell them.

AT&T

leveraged the telegraph and telephone to connect people who wanted to talk.

Each of these companies scaled rapidly by creating technology that enabled networks to grow organically. And the great news? Financial services executives like yourself can adopt this model to grow faster, smarter, and more efficiently.

The Financial Services Opportunity:

Connecting Advisors and Clients

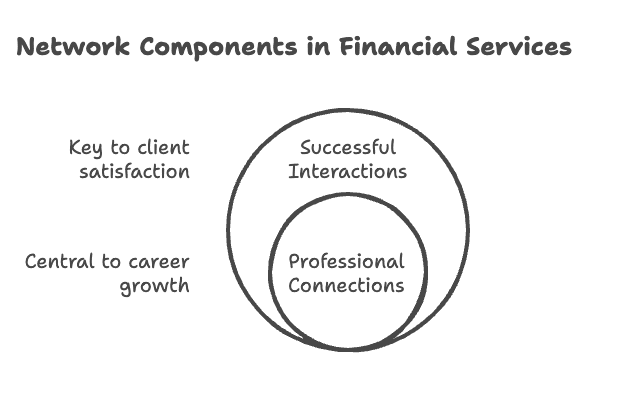

In financial services, your network has two critical components:

1. Advisors who want to grow their books of business.

2.Clients (business owners, individuals, families) who need financial solutions.

The technology, Pocket Plan, that sits in between—is a platform that seamlessly connects advisors with clients—is your secret weapon. When you leverage this kind of network, your business gains three undeniable advantages:

Exponential Growth Through

Connection

Each time a new advisor joins your network, they bring in their own relationships and referrals. This strengthens the entire system. Similarly, each new client creates an opportunity for your advisors to deliver value, which strengthens trust and retention. It’s a virtuous cycle. As more advisors and clients use the platform, the network itself becomes an invaluable resource, making it harder for competitors to replicate your success.

Efficiency Through

Technology

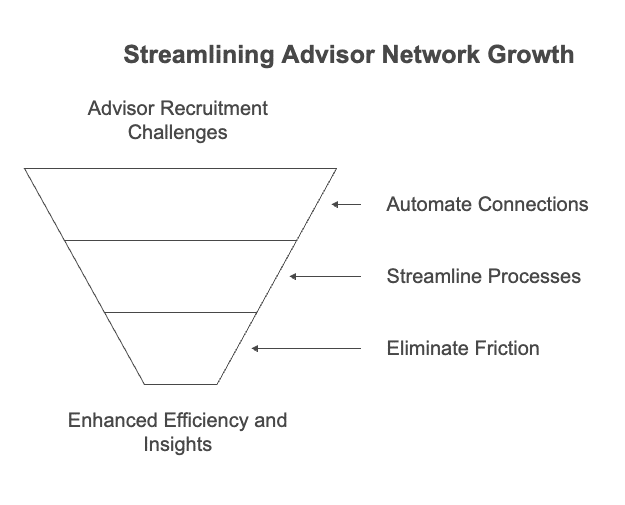

Let’s face it: growing your advisor network is a challenge. Recruitment can be slow, and managing existing agents takes time, resources, and energy.

According to Cerulli Associates, the financial advisor headcount remained largely unchanged in 2023, with a net increase of just 2,706 advisors in 2022.

With technology, you can automate connections, streamline processes, and eliminate friction. Platforms like Pocket Plan—built with network effects in mind—simplify the relationship between advisors and clients. Advisors get better tools to serve clients quickly, while you, as a leader, gain real-time insights into performance, opportunities, and gaps.

This efficiency means:

- Faster onboarding of new agents.

- Advisors spending more time serving clients, not chasing paperwork.

- Improved ability to scale without increasing overhead.

Building an Unshakeable

Competitive Moat

Here’s the biggest fear for many executives: What if your competition swoops in and wins over the business owners you’ve spent years serving?

The beauty of network effects is that they create stickiness. As more advisors and clients rely on your platform, the value they receive grows—and they have fewer reasons to leave. The network itself becomes your moat.

Think of it like Uber versus taxis. A traditional taxi service can’t suddenly replicate Uber’s global network of drivers and riders. Your competition can’t replicate the network you’ve built either.

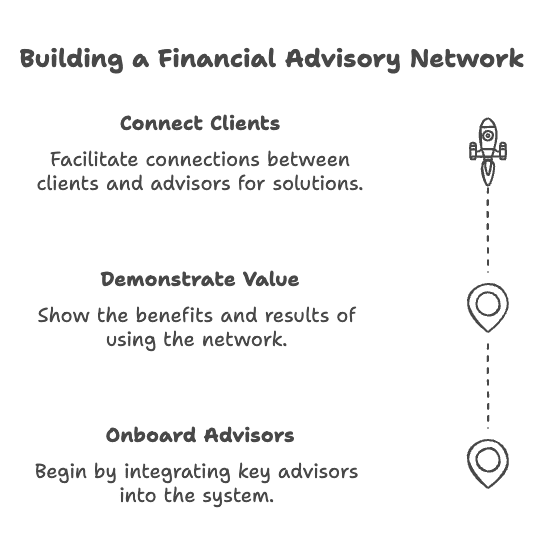

Overcoming the Cold

Start Problem

Now, you might be wondering: How do I start building a network if I don’t already have one?

This is where the concept of the “Cold Start Problem” comes into play—a challenge all successful network-based businesses face. The key is to focus on providing immediate value to your first set of advisors and clients. Once they experience the benefits, the network grows organically.

For the Gradient financial services network, the first step is to onboard key advisors onto Pocket Plan who can bring value and demonstrate results. From there, momentum builds. Imagine the value prospects and leads will feel having a financial assistant in their pocket. Are they wondering about their holiday budget? Check Pocket Plan. Should they roll over their 401k plan once they retire? Check Pocket Plan. This technology not only enables them to get answers, but it connects them with advisors who provide solutions.

Why Now?

The Future Belongs to Networks

The financial services industry is at a crossroads. Technology is reshaping how advisors deliver value, and business owners expect more seamless, personalized solutions.

If you’re frustrated by slow agent growth or the inefficiencies of traditional business models, network effects are your answer. By connecting advisors and clients through a scalable platform, you create a business that doesn’t just survive competition—it thrives in it.

The Next Step: Build Your Flywheel

Imagine the future of your business:

- Advisors effortlessly connect with the right clients.

- Technology drives efficiency, insights, and scalability.

- A growing, self-sustaining network that builds value with every new participant.

This is the power of network effects. The opportunity is clear: leverage the technology that enables the network, and you’ll build a legacy that lasts for decades to come.

If you’re ready to turn this vision into reality, the time to act is now. Let’s get that flywheel spinning.

For further reading on network effects and their transformational power, check out The Cold Start Problem by Andrew Chen.