Cash Flow

Net Worth

Investment

Income Statement

Future Spending

Custom Scenarios

Monitor your transactions with easy categories like Essential, Non-Essential & Savings.

Measure your progress to building wealth by viewing your Assets and Liabilities direct from your account.

Keep your focus on the core changes in your securities. Highlight position.

Move closer to your goals by viewing your income sources, growth and more.

Review your Retirement cash flow by looking at the numbers as they will be worth today or in the future.

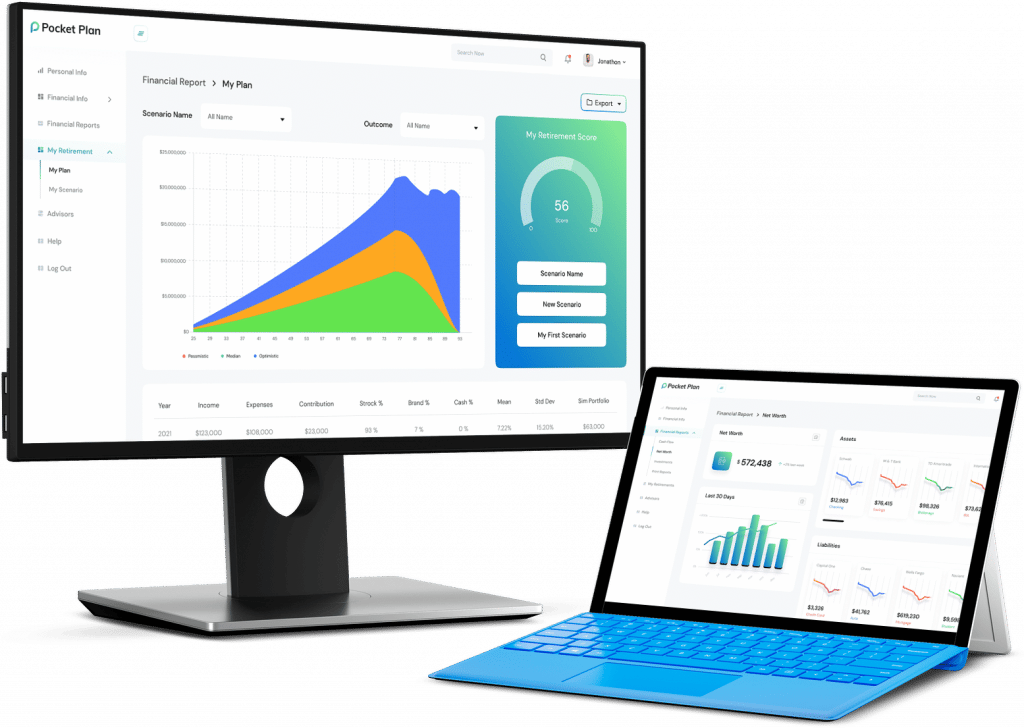

Build custom scenarios to test the impact of decisions. Keep them yourself or share with others.

24/7 Support

Get technical support or speak with a licensed financial professional via web or phone whenever you need help.

Data Privacy

Encrypted data privacy so you can always have confidence that your data is protected guaranteed.

Friendly Design

Get answers to your questions with ease to improve your finances

App Features

Frequently Asked Questions

Your trust has to be earned. That’s why we’re up front about how we keep your data secure and how it’s used to help build your Financial Freedom Plan.

Your Pocket Plan is an encrypted real time view of your most important financial information. It’s organized to help you reach financial freedom or the ability to stop working without changing your lifestyle. By focusing on your big picture we help you build a plan to replace 5 – 15 x your annual income.

Control your data and who has access to it. Use Pocket Plan to permission access to a snapshot of your account balance, transactions and investment holdings. This data is then sorted and organized to produce professional grade financial reports to help you make smart decisions.

Pocket Plan has view only access to your financial account data. We use encrypted third party tools to take a snapshot of your data and build reports. You choose which accounts are added and who has access.

Your Retirement Score is an estimate of the odds that you run out of money before age 86. This is the median expected life span in the US according to Social Security estimates. The closer your score is to 100, the better your odds of not running out of money.

You can improve your Retirement Score by growing your investable assets and improving your cash flow. Use Scenarios to test which changes can make the best impact. Learn more about scenarios here.