In this blog post, you’ll learn how to use your retirement score to help reach your goals faster with Pocket Plan.

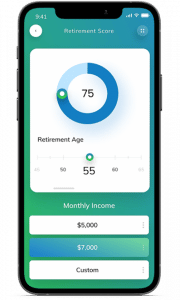

Your retirement score is a measure of the odds that your money will last until age 86. The longer your money lasts, the higher your retirement score will be. So, if you have a high retirement score, that means that you have good odds, right? You will not run out of money before age 86. If you have a low retirement score, that means that you are going to run out of money before the intended time. We test that using a bell curve and by organizing the results.

What Pocket Plan does for you is it simulates the odds of success of you having money until age 86, where you test that with your retirement score. The first thing that we want to do is to look at the assumptions to calculate your retirement score. How is the retirement score calculated?

It is calculated using your personal information, including what your current age is, when you’re going to retire, how much money you need in retirement, how much money you have invested now, and how much you’re going to be saving in the future. We also, look at your inflation rate, when the money is going to end, or when you expect to die.

Then, we look at how you define success. What we do then is simulate your scenarios, starting at your current age and going all the way out. In this case, until age 96 and each year, we have calculated what your expected portfolio is, and then what your simulated portfolio is. Your expected portfolio shows you if the returns continue year after year, and what the value will be. If they continue at a set amount year after year, then this is the value that you expect with your simulated portfolio.

We’ve used real market returns based on the historic performance of the S and P 500. Using the historic performance, we can show what the returns during a specific period are or, a set period of years depending on how long you need your money for. For instance, looking at random returns from 1929 until 1959 or 1930 to 1960, or 1961 to 1991. If we wanted to look at a span of 30 years, using that for your simulated portfolio, we can mimic real-world results.

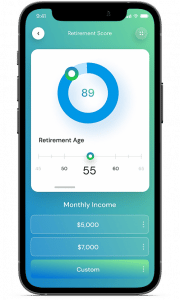

We’ve added a random variable to test out how likely the odds of success are. We want it to be as close to reality as possible. Now, we’ve done this a thousand times, so you can go all the way up to 5,000 times. It may take a little longer to do 5,000 times but, we can run the retirement score for any scenario that you want. Depending on what your goals are, you can test your retirement score and figure out how close you are to your goals. Every time that you do the calculation, it will change your expected portfolio and your simulated portfolio. What’s great about this is that you can look at your best case, worst case, or median results.

I would stick to the median results most times, but it depends on your view on things and results. That gives you a good framework for the odds of success. Then, if you want to improve your retirement score, all you do is change the inputs.

If you are going to be receiving income while you’re living abroad, you will not need 70% of your income. You only need 50% of your income. What you would do is you’d create a new scenario. You could put in 50% income and retire at 60. That creates a new scenario where you’ll be able to add and customize all the inputs here.

So, we’ve got an income replacement rate at 50% there. The retirement age is 60, and then everything else is the same. We’ll save the scenario. Now, the retirement score is in the plan section. If we want to increase the retirement score, we can go into the scenario and change the inputs.

We’ll save it.

Then, we’re going to go back to my plan and we’re going to test the impact. We need to keep on tweaking these inputs to get a solid retirement score. One thing I want to point out here is in the computation I had added the 5.4% inflation rate that’s reflective of the current environment. But, if I were to drop that down to the historic average, 2.4%, you see how that changes the retirement score. Notice that changing these inputs is going to change the outcome of the retirement score.

This is a great starting point to understand what factors influence your success and having financial security. Notice there that what I did was I changed the savings rate to 15%. When I did that, it increased the retirement score. Your retirement score can help to get an understanding of what your finances could look like in the future. It can also help understanding how changes to your finances will influence your future financial wellbeing.

If you have any questions, please let me know. Also, if you would like to see the step-by-step process how we do this, you can check out the video above. To learn more about Pocket Plan visit our Home Page or to start your journey to Financial Freedom visit our: Getting Starting Guide