An Advanced Medical Directive: What it is and How to Create One

As we go through life, we may face unexpected situations where we cannot make medical decisions for ourselves. In such cases, an Advanced Medical Directive (AMD) is a legal document that can help guide our healthcare choices. An AMD allows us to appoint a trusted individual as our agent to make medical decisions for us if we become incapacitated or unable to communicate. In this blog post, we will discuss what an AMD is, how to create one, where to file it, where to store it, and when to update it.

What is an Advanced Medical Directive?

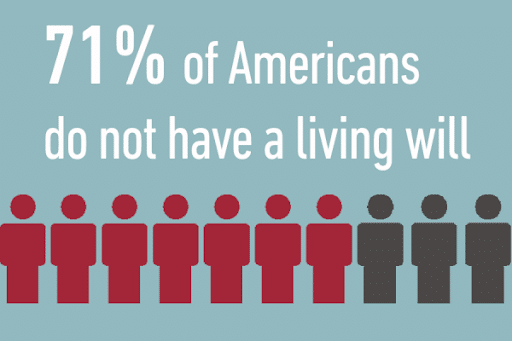

An Advanced Medical Directive is an estate planning document that gives people the power to make medical decisions for us if we become incapacitated. This document is also known as a Living Will, Health Care Directive, or Medical Power of Attorney. It is a legal document that states our wishes regarding medical treatment if we cannot express them ourselves. The AMD is a way to ensure that our medical care is in line with our values and preferences.

Separating Powers: Operational and Financial

As a business owner, you probably want to separate powers between operational and financial. Similarly, when creating an AMD, it is essential to consider who the successor agent is and when they can take authority. The successor agent is the person who will take over as the decision-maker if the primary agent is unable to act. It is important to choose someone you trust and who shares your values and beliefs.

When choosing a successor agent, consider their availability, willingness to take on the role, and their ability to communicate with healthcare providers. You may also want to consider the circumstances in which they can take authority, such as disability, death, or incarceration.

Creating an Advanced Medical Directive

Creating an AMD involves several steps. The first step is to decide who you want to appoint as your agent. It is crucial to choose someone you trust and who understands your values and beliefs. Once you have chosen your agent, you should discuss your wishes with them and make sure they understand your healthcare preferences.

The next step is to complete an AMD form. You can find these forms online or from an estate planning attorney. The form typically includes the following information:

- Your name, address, and contact information

- The name, address, and contact information of your agent

- The circumstances under which your agent can take authority

- Your healthcare preferences, such as whether you want life support, pain management, or resuscitation

- Any other instructions you want to provide, such as your religious or spiritual beliefs

Filing an Advanced Medical Directive

Once you have completed the AMD form, you should file it with your state’s health department or other relevant agency. You should also give copies to your agent, your healthcare providers, and any family members or loved ones who may be involved in your healthcare decisions. It is important to keep a copy of the AMD in a safe and easily accessible place.

Storing an Advanced Medical Directive

The AMD should be stored in a safe and easily accessible place. You may want to keep a copy with your other important documents, such as your will or insurance policies. You should also give a copy to your agent and any healthcare providers who may be involved in your care. You may also want to consider storing a copy of the AMD online, such as on a cloud-based platform, in case the physical copy is lost or damaged.

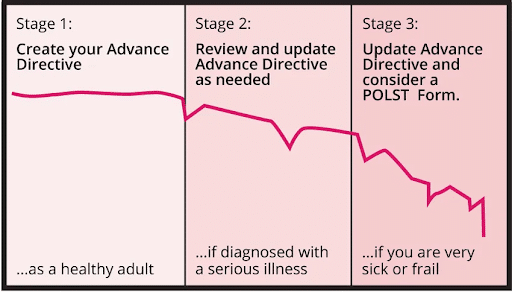

Updating an Advanced Medical Directive

It is important to update your AMD regularly, especially if your healthcare preferences or circumstances change. You should review your AMD every few years or after any major life event, such as a divorce, marriage, or the birth of a child. You should also review it if you move to a new state or if there are changes in the laws related to healthcare directives.